Leverage: 1:30 | 1:2000

Regulation: CySEC, FCA, DFSA, FSCA, FSA, CMA

Min. Deposit: 0 US$

HQ: Cyprus

Platforms: MT4, MT5, HFM Trading App

Found in: 2010

HFM Licenses

HF Markets (Europe) Ltd – authorized by CySEC (Cyprus) registration no. 183/12

HF Markets (UK) Limited – authorized by FCA (UK) registration no. 801701

HF Markets (DIFC) Ltd – authorized DFSA (Dubai) registration no. F004885

HF Markets (SV) Ltd – authorized by FSA SVG registration no. 22747 IBC 2015

HF Markets (SV) Ltd – authorized by FSC (Mauritius) registration no. C110008214

HF Markets SA (PTY) Ltd – authorized by FSCA (South Africa) registration no. 46632

HF Markets (Seychelles) Ltd – authorized by FSA (Seychelles) registration no. SD015

HFM Investments Ltd – authorized by CMA (Kenya) license no. 155

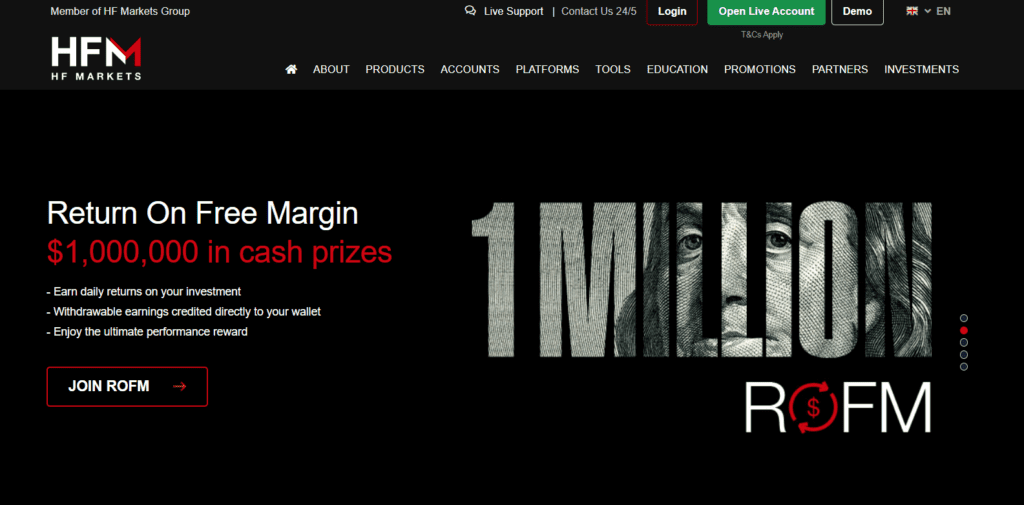

What is HFM?

HFM is a multi-asset Forex broker that offers Forex and Commodities trading while previously was known as HotForex.

HFM offers CFDs trading services choice of 7 account types and trading platforms with tight spreads averaging EUR USD 0.1 also operating unrestricted liquidity. Which is allowing any size or profile trader choose between various spreads and liquidity providers via automated trading platforms and perform any strategy, including News trading.

- The brokerage firm itself was established in 2010 with its headquarter in Cyprus, yet in addition serves several global offices including Dubai, South Africa also offshore entities in St Vincent and the Grenadines.

- While indeed HFM shows great interest and impacts mainly in Africa (see Ghana Brokers), Asian and MENA regions which bring some of the great opportunities to global residents and plus to International proposals overall.

Besides, HFM offers its trading service along with the applicable licenses in each region it operates that regulate the Forex industry, therefore delivers service trustworthily.

HFM Pros and Cons

HFM is a broker with a good reputation and regulations based on our finds. The offering is user friendly, we mark large portfolios for Forex and CFDs instruments, while fees are considered low compared to other popular brokers, besides minimum deposit is among lowest in industry allowing any size of traders to sign. Also, there is truly remarkable education section suitable for beginning traders and one of the best ranges our financial experts saw of webinars and seminars performed globally.

On the other hand, HFM has limited portfolio for EU clients, with only Forex and CFDs are offered. Also, international trading is done via offshore branches with lower requirements, however HFM has good reputation so is considered to sign in.

| Advantages | Disadvantages |

|---|---|

| Founded in Cyprus known for its great technology | International offering done via offshore |

| Regulated Financial Conduct Authority FCA, CySEC, South Africa etc | |

| Broker with some of the best range of Forex and Commodities markets | |

| Numerous industry awards | |

| Low First Deposit | |

| Low Fees |

HFM Review Summary in 10 Points

Headquarters Headquarters | Cyprus |

Regulation Regulation | CySEC, FCA, DFSA, FSCA, CMA |

Platforms Platforms | MT4, MT5, HFM Trading App |

Instruments Instruments | 17 trading tools with Forex, Indices, Metals, Energies, Shares, Commodities, Bonds, ETFs, DMA Stocks, and Cryptocurrencies |

Demo Account Demo Account | Available |

Minimum deposit Minimum deposit | 0 US$ |

EUR/USD Spread EUR/USD Spread | 1 pips |

Base currencies Base currencies | Several currencies available |

Education Education | Trading Academy, Webinars Seminars, Numerous Tools |

Customer Support Customer Support | 24/5 |

Overall HFM Ranking

Based on our Expert finds, HFM provides good trading conditions that might be some of the best for Forex trading and CFDs trading, also available in a global scale for international trading. HFM is suitable for various traders including European clients, Africa and Asia traders, also beginning traders and experienced looking for good technical trading solutions.

- HFM Overall Ranking is 9 out of 10 based on our testing and compared to 500 other brokers, see Our Ranking below compared to other popular and industry Leading Brokers.

HFM Alternative Brokers

Yet, we found not very wide range of trading instruments for European clients, it might be the case of regulations, but yet is good to check other industry proposals too. Besides DMA access to Futures or Indices trading is not available too.

Awards

Besides its looks to us an attractive trading proposal at first look, there are some confirmations about its trustworthy business due to official figures and numbers, as well as numerous industry awards that HoForex holds and counting. We also saw great development of HFM along the ttime, before broker mainly operate in Europe and now is one of the trully global brokers with great coverage of regions.

- Until now there are more than 500,000 Live accounts opened with the HFM, along with multiple Industry awards and sponsorship HFM prestigious titles recognize as Best Clients Funds Security Broker, Best Forex Provider, Top 100 Companies etc, see our snapshot find below.

Is HFM scam or safe Broker?

No, HFM is not a scam, we consider HFM a safe broker due to being licensed by several top authorities including FCA, FSCA and CySEC.

- HFM is a brand name of HF Markets (Europe) Ltd. that is authorized and regulated by the CySEC a regulatory authority for Investment Services firms in Cyprus, also operates with cross-border licenses, authorizing HFM to provide investment services within EEA zone.

In simple terms it means the broker is regulated and authorized to offer its trading service along with necessary safety measures and controls applied.

Where HotForex located?

In addition to its main license from CySEC, the broker holds other licenses to be able to serve clients from some specific jurisdictions including South Africa, Dubai, England etc. Besides, wee see obvious evolvement in HFM growth and regulation, now Broker operates fully legally in Africa region too with South Africa and Kenya obtained licenses.

Also, there are HFM entities that are registered in offshore zones alike Mauritius, SVG and Seychelles. While our general recommendation is not to trade with offshore brokers as they simply do not regulate Forex trading, due to HFM multiple parallel regulations it is considered to be safe to trade with them.

See our conclusion on HFM Reliability:

- Our Ranked HFM Trust Score is 9 out 0f 10 for good reputation, excellent service for years and constant growth and reaches to more jurisdictions. HFM holds reliable top-tier licenses, is one of the biggest Brokerages worldwide, while the only point is International trading available via the offshore entity.

| HFM Strong points | HFM Strong points |

|---|---|

| Authorized and Regulated by CySEC, Financial Conduct Authority FCA, FSCA South Africa | Three entities based in offshore zones |

| Negative balance protection | |

| Constant enlarging of licenses | |

| Global reach with available access of Asia, Africa regions | |

| Additional Civil Liability Insurance |

How are you protected?

For the funds protection, which is an important part of the regulated broker, HF Markets (Europe) Ltd. is a member of the Cyprus Investor Compensation Fund. It constitutes a claim of the covered clients against investment firms. Clients’ deposits are protected under the requirements of the regulators.

While in addition to that HFM safeguard traders with a Civil Liability insurance program for a limit of €5,000,000, which includes coverage against errors, omissions, negligence, fraud and various other risks that may lead to financial loss, giving extra layer of protection and another good point to our HFM Review. However, according to applicable laws and regulations, the conditions vary from one entity to another, see our snapshot of HFM licenses below.

Leverage

While trading with HFM we founf availabilitty of fixed or floating leverage, which is indeed a very useful tool, especially for traders of smaller size. Leverage brings an opportunity to increase your potential gains through its possibility to multiply balance in a particular number of times. Yet remember that leverage may work in reverse too, defining also your risks, that is why it’s so important to understand how to use tool smartly.

HFM offers various leverage levels from the “modest” one as determined by European regulations allowing 1:30 for Forex instruments, and up to very high ratios of 1:2000 available via international branch. Yet, again always make sure to learn about high risks of leverage, as retail trading accounts lose money rapidly due to high leverage.

Therefore, your leverage levels are firstly settled according to the regulatory requirement in the region or another also your prof level in finance, so make sure to verify with the customer support team which one you entitled to.

European entities that oblige to ESMA regulation, the maximum leverage ratio is set to a 1:30 on Forex instruments, 1:25 Spot Metals, etc.

South Africa residents may access leverage of up to 1:200

Higher leverage ratios like 1:400, 1:500 or even 1:2000 are offered through HFM offshore entities since a particular registration does not limit offering and allows high leverage levels.

Account types

HFM provides an variety of account options with 6 different accounts based on specific requirements. The range offers Micro, Premium, Zero spread, HFCOPY, PAMM Premium Accounts, and Swap Free Accounts, also you can select the Islamic Account suitable for traders from the MENA region or beyond.

- From the very beginning, you may sign in for Demo Account and then transfer it to a Live one just by depositing money.

- Each of the account types brings good flexibility and allowing to choose based on your trading strategy, allowing either beginning traders, investors or professionals to find its own way in trading.

- Another good point we admit is the opportunity to trade Micro lots, use Cent or Nano account, or specify account for Copy Trading. You may see below in our HFM Review snapshot below details of each, also negative and positive points to consider:

| Pros | Cons |

|---|---|

| Fast Account Opening, fully Digital | Accounts and offer depends on the entity |

| 6 Account types | Some conditions are not available in some regions |

| Great options for a particular trading style | |

| Very Low Min deposit free of charge | |

| Micro Account, Cent Account and Islamic Accounts offered |

How to open HotForex Demo Account?

To open a Demo account is pretty easy since there is no verification is needed at this step, we were able to open demo account in minutes. While you should simply follow the process of risk-free account opening on HFM website and get access to either MT4 or MT5 platforms with unlimited demo funds. So here is the step by step process of Demo Account opening:

Opening Trading Account step by step:

1. Go into HFM Demo Account Sign In page

2. If you are a new client enter your personal data First and Last Name, Country of residence, email, phone, etc. Or in case you’re existing client follow sign in

3. Fill in all required information for the first register of myHF

4. An account will be approved almost immediately, where through your client area you can get access to New Demo Account, next you can follow with Live Account submit to manage your funds

How to open HotForex Live account?

Once you ready or decided to start Live Trading you can submit for a Live account where HFM may ask you for confirmation of your documents including identity, residency and other proof before you start. In both cases, you will get access to myHF client area where you can manage all your accounts and finances.

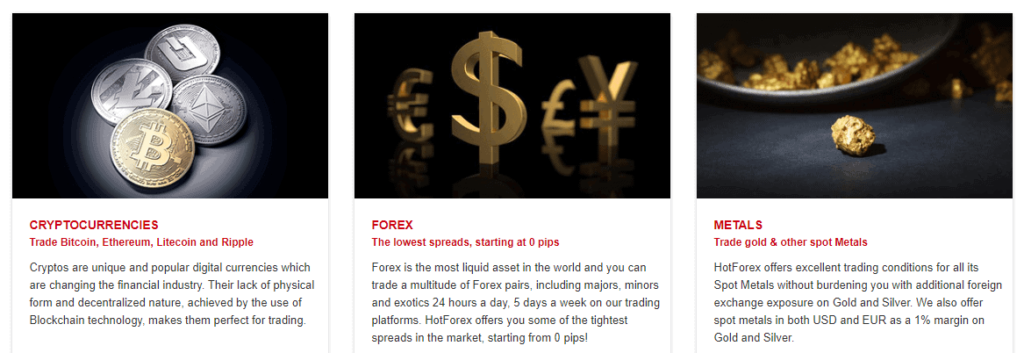

What Instruments I can trade in HFM?

One of the HFM Pros also is offered market range that includes 17 trading tools and 150+ trading products with access to global markets. These include Indices, Metals, Energies, Shares, Commodities, Bonds, ETFs, DMA Stocks, and included for last years offering to trade Cryptocurrencies with Bitcoin, Ethereum, Litecoin, Ripple and more.

HFM Fees

HFM trading costs mainstays at the tight spread offering in general andl bringing some of the most attractive spread opportunities among the industry as we conclude based on our research, also proposing spreads from 0 pips on some accounts. However, is good to check on the additional, non trading fees and charges for deposits or withdrawals all in all concluding your trading costs, see fee table below:

HFM Fees are ranked average, low with overall rating 8 out of 10 based on our testing and compared to over 500 other brokers. Fees are different based on entity, yet traders can use free deposits and withdrawals mainly worldwide

Overview of the Non Trading Fees

Important to consider, there is a fee charged in case you didn’t use your account and show no activity for 6 months or more. After this your account entitled to 5$ HFM inactivity fee per month.

Spreads

HFM fees are built in a transparent manner while the only charge is variable spread, which is a difference between bid and ask price, also HFM does not offer fixed spread (Find fixed spread brokers list here). HFM does not charge additional fees or commission, thus your calculation of the position is quite seamless and easy despite the level of trader you are, see our spread finds below:

- Spreads fees defined by the account type you use, thus Micro Account spread starting from 1 pip and Zero Account offers 0 fee which averages on 0.2 pips most often.

- However, the difference between trading costs also defined by the margin requirements, which increase almost double in case you wish to trade with 0 spread. So make sure to verify account conditions in detail before you sign in.

Below you may see a comparison of the most popular instruments, the typical spread based on Standard conditions, as well for your information compare fees to another broker FP Markets.

- HFM Spreads are ranked average/ low with overall rating 8 out of 10 based on our testing comparison to other brokers. We found Forex spread lower than the industry average of 1.2 pips for EURUSD which is great plus

Overnight Fee

As well always consider overnight or rollover fees as trading costs in case you holding an open position longer than a day. This fee is defined by each instrument separately and you will see it directly from the platform or upon the opening of the trade, see below example with Cryptocurrencies.

However and unless you trading through swap-free accounts designed to traders following Sharia rules, as these accounts restricted from any interest rates or swaps.

Fee conditions upon opening of trade

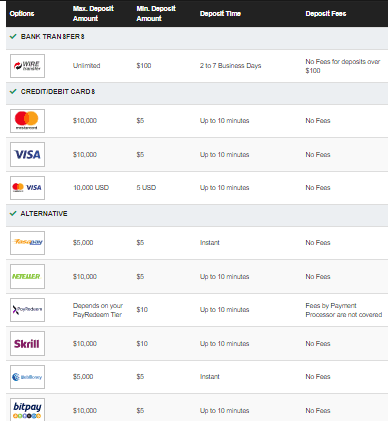

Deposits and Withdrawals

There are multiple ways to fund trading accounts supported by HFM. Besides broker issue its very own HFM MasterCard for a straight transaction and the ability to make safe online payments.

- HFM Funding Methods we ranked Excellent with overall rating 10 out of 10. Minimum deposit is among lowest in industry, also Fees are either 0 or very small, besides range of supported funding methods is good, but be sure to verify conditions with entity you trade

Here are some good and negative points on XM funding methods found:

| HFM Advantage | HFM Disadvantage |

|---|---|

| Minimum deposit – 5$ for Micro Account | Methods and conditions vary based on entity |

| Wide range of deposit option including Credit Card, Bitcoin, WebMoney and fasapay | |

| Free deposit and withdrawals |

Deposit Methods

One of the great points in we found is that HFM offers over 14 methods to deposit or withdraw money, also along the time adding more methods based either on new offerings like Crypto Deposits or enlarging accessibility to local transfers or payment methods available at the regions. Those methods include:

- major credit and debit cards

- wire transfers and domestic transfers available at some regions

- vast of e-wallets, including Cryptocurrency Deposit, fasapay, WebMoney, and more.

How do I deposit money on HFM?

So in order to deposit money on HFM you simply need to select the payment provider of your preference, as well as the one that is available in your region, and proceed with the payment. HFM will process your withdrawal within a short time and is available 24/5.

What is the minimum deposit for HotForex?

HFM minimum deposits start from 0$, yet, if you just make a first deposit check out preferences on a minimum requirement according to the account type as well, also determined by the payment method you would choose.