Choosing the best Forex broker involves a thorough evaluation of several key factors to ensure that the broker aligns with your trading needs, goals, and preferences. Here’s a step-by-step guide to help you make an informed decision:

Regulatory Compliance

The first and most crucial step is to verify that the broker is regulated by a reputable financial authority (such as the FCA, ASIC, CySEC, or CFTC). Regulation ensures that the broker adheres to industry standards and offers a degree of investor protection.

Click here to read What Makes a Great Forex Broker

Trading Platform and Tools

Assess the trading platforms offered by the broker. Look for platforms that are user-friendly, reliable, and equipped with the necessary tools (like charting, technical analysis tools, and news feeds) for effective trading.

Account Types and Requirements

Evaluate the different types of accounts the broker offers. Consider factors like minimum deposit requirements, leverage options, spreads, commissions, and margin requirements.

Transaction Costs

Understand all costs associated with trading, including spreads, commissions, and any other fees. Compare these costs across brokers to find competitive rates but be wary of rates that seem too good to be true.

Deposit and Withdrawal Procedures

Ensure the broker provides smooth and straightforward deposit and withdrawal processes. Check for any fees associated with withdrawals and the time taken to process these transactions.

Customer Service and Support

Good customer service is essential, especially in a 24-hour market. Test the broker’s customer support for responsiveness, availability, and helpfulness.

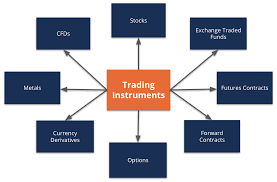

Trading Instruments

Consider the range of trading instruments offered. If you plan to trade beyond Forex, check if the broker offers other assets like commodities, stocks, indices, or cryptocurrencies.

Leverage and Margin

Understand the leverage options available and the broker’s margin requirements. Remember, higher leverage can increase potential profits but also increases risk.

Educational and Analytical Resources

A broker that offers comprehensive educational materials and market analysis tools can be particularly valuable for new traders.

Security

Check the security measures the broker has in place to protect client funds and personal information, including data encryption and two-factor authentication.

Reputation

Research the broker’s reputation. Look for user reviews, industry awards, and years in business. Be cautious of brokers with consistently negative reviews or a history of regulatory fines.

Demo Account

Before committing real money, use a demo account to familiarize yourself with the broker’s platform and services.

Market Execution and Slippage

Understand how the broker executes trades and their policy on slippage, which can affect order execution, especially in volatile.