The US dollar plays an incredibly important role in the global economy and, even if allegations of “dedollarization” can arise, the American currency has reached a new record of use last year and remains the main global reserve currency.

- The US dollar is the reserve currency of the global economy, which has both advantages and disadvantages.

- What makes the US dollar move is more urgent for traders, which testifies to the composition of the US dollar, and the DXY is made up of a basket of underlying currencies.

- The currencies constituting the basis of the financial system, the only way to enhance a currency is to use other currencies. Consequently, Forex cash markets are often negotiated by pairs due to their relative valuation. But for the US dollar as a single Actif, it depends on the underlying currencies that contribute to creating its value.

The US dollar plays a unique role as the main reserve currency of the global economy. This is the case since the end of the Second World War, with the conference of Bretton Woods in 1944. At this conference, the world saw the creation of the IMF and the World Bank and a exchange rate system was developed in which each country fixed the value of its country. From their currency to the US dollar, itself convertible into gold at $ 35 an ounce. So, in essence, this has created a global currency attached to the price of gold using the US dollar as a channel. The design was well intentioned, to provide a certain element of stability and prevent monetary devaluation regimes designed to stimulate the national economy to the detriment of business partners (everyone’s strategies for themselves).

Of course, this situation was not viable because there was not enough gold to respond to the growing number of US dollars in circulation and, in 1971, the system began to collapse. It was replaced by the Smithsonian agreement a few months later, ten countries trying to save the rate fixing system, but this also failed and, in 1973, the current floating rate regime was in place. However, the importance of the US dollar in the world economy did not dissipate after the dissolution of Bretton Woods or the Smithsonian agreement; And even today, many savings manage their currencies depending on the US dollar, often using a negotiation range or an acceptable price range with which they will fix their currencies compared to the value of the US dollar.

This tradition, combined with the role of the United States in the world economy, encourages many central banks and savings to hold American dollars on deposit, and the definition of a reserve currency is a foreign currency held in large quantities by the central banks as part of their exchange reserve activities

The graph below, taken from the COFER (monetary composition of the official exchange reserves) of the IMF, shows the magnitude of this allowance at 59.17%.

Being the main global reserve currency has certain advantages, but also has certain disadvantages. This increased request actually gives birth to the “King Dollar” which is often mentioned in the media, especially during prolonged trends in the strength of the US dollar. And these trends can have connotations for business partners, which has also led to the expression “the demolition ball of the US dollar” or “the US dollar”. “Milkshake theory in US dollar”

Given this increased request for money from central banks and neighboring business partners, it also benefits from lower interest rates. As the global demand for US dollars remains high, the US government has the opportunity to issue lower cost bonds, which can help maintain low rates in the United States. The other aspect is that of trade deficits, with this additional US dollar demand which makes money “relatively expensive”, which means cheaper imports and more expensive exports. This can prevent US companies from doing business abroad and it can become even more pronounced in times of economic crisis, when the flows go to the US dollar as a refuge value. The strength of the US dollar is also a reason why the manufacturing industry has been largely relocated, because it is simply more profitable to produce products and pay workers in a foreign currency which is not stimulated by additional demand reserve status.

It should also be noted that, in a context of lower rates, the US government has been able to emit more and more debt, which, in the long term, may not be a good thing.

The importance of the US dollar in the trade and world payments also allows the US government to extend its influence on other questions. Any trade carried out in USD can be subject to American sanctions, and by eliminating the possibility of doing business with the US dollar as a medium, the US government can, in substance, cut short an economy and impose its point of view on a question. The more popular the US dollar, the greater the effect it can bring; Although it is risky, because it could have a return of flame if it gives big savings a reason to start diversifying their foreign currency reserves by moving away from the US dollar. Treasury secretary Janet Yellen spoke about it as a risk for the hegemony of the dollar. This is often one of the reasons invoked to justify the allegations of “dedollarization”, according to which the dollar could begin to lose its appeal as a global reserve currency, given some of the dynamics that underlie money and the economy .

Dedollarization

Since we approach the subject, you might as well mention it because it often comes up, in particular after an extended period of weakness in the US dollar.

The currencies are unique as a class of assets since they constitute the basis of the financial system. As such, the only way to enhance a currency is to use another motto, which is why many Forex spot markets are negotiated in pairs. And at the same time, if the US dollar must lose its reserve currency status, another currency will have to replace it. Even if we have addressed certain advantages above, there is also an important drawback, namely the risk for the domestic market. Changes can have repercussions, and as we saw with the Japanese Yen after the Plaza agreement in 1985, the strength of money could produce a massive chain reaction in the economy that could last decades.

Imagine, for a moment, that the euro is starting to take part of this reserve allowance, and that the circular graph referenced above shows that the shaded area in clear blue of the euro encroaches more in the shaded area in blue more dark dollar. Well, this additional request in currency also means a possible push of inflation, because this stronger value of money will make imports cheaper and exports more expensive. From this relationship, consumers could be encouraged to buy the imported product while avoiding national manufacturers, and for exported products, they will not be as attractive because they are relatively more expensive. The national manufacturer is therefore affected on both plans, for its sales outside the country as well as for those of its own economy. This could lead to a slowdown in economic growth, but

Trader the US dollar

A sentence from our previous section defines a remarkably unique aspect of trading in the US dollar. Since currencies constitute the basis of the financial system, the only way to enhance a currency is to use another. Given the role of the US dollar as a global reserve and its place in the world economy since the end of the Second World War, it retains an important role in daily commercial operations on markets and sectors. And this also applies to the retail merchant.

A pair of currencies is often considered a “major pair” if the US dollar is in the rating. Thus, EUR/USD, GBP/USD, USD/JPY – would all be considered as major pairs. These pairs will generally retain greater liquidity and greater volume and for traders who wish to make a transaction on a cross pair like the GBP/JPY pair, in particular if they wish for an important allowance, they will be able to choose to create their own Crossing by buying or selling the pair the pair GBP/JPY and then buy or sell the USD/JPY pair. If the trader buys the US dollar from one pair and sells it in another, he has actually created his own cross pair with an exhibition at the GBP/JPY pair.

For a major pair like the EUR/USD, the rating can simply be read as “the value of a euro in US dollars. “This can simplify things for those who learn the appearance of matching the Forex market, but what about the trader who wishes to carry out a transaction on the US dollar itself?

Well, this is where things are starting to become more difficult, because no US dollar is negotiated on the cash currency markets; Because the only way to assess the US dollar is to use another currency. The only market often considered representative of the US dollar is the long -term contract of the Doxy index.

The US dollar index under the name of “Dxy” is a basket of six currencies that make up the value of the US dollar. Six currencies may seem very little, and it is true that the basket ofx was initially created in 1973, when the currency was authorized to float freely compared to global currencies after the dissolution of the Order and the Smithsonian agreement mentioned above. At the time, there was no euro and China had little international trade, so that the basket was largely made up of European currencies, such as the West Germany and French Mark; But the euro replaced five of the ten currencies that were in Dxy when it was created in 1999.

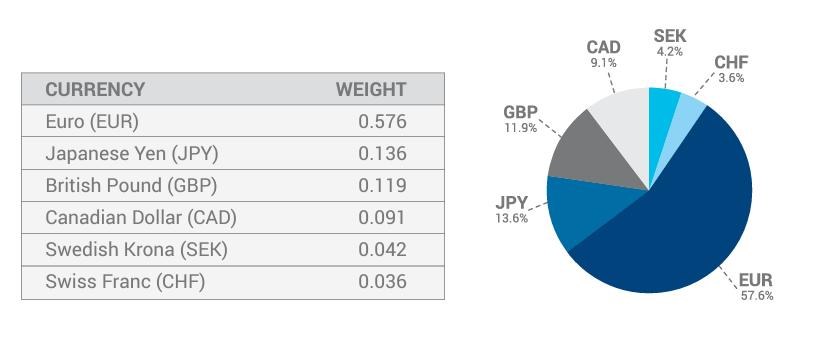

At this stage, it can be said that the composition of the Dxy does not correctly reflect global trade flows because there is no Chinese yuan and the only allowance in Asia represents only 13.6% of the Japanese yen. The table below presents the complete distribution of the basket of Doxy currency, drawn directly from the product guide of the Intercontinental Exchange (ICE).

What influences the value of the US dollar?

Like most other currencies, the main determining factor can often be interest rates. As interest rates increase, the attraction of holding this currency also increases because a higher rate is attached to it. This may appear directly in swap or rolling credits to maintain this pair beyond the 8-hour deadline. But what may be more important for the market player is that if others also implement this point of view, the value of the asset can increase due to additional demand.

A good example is the trend observed from 2021 and the first nine months of 2022. The American federal reserve quickly adjusted interest rates, which increased the appeal of the US dollar. Meanwhile, the Bank of Japan was more uncertain about growth and inflation, and it did not share the same motivation as to the maintenance of low rates. This difference between savings has created increasingly important rolling payments, which led to an increase in demand.

The USD/JPY pair reached a hollow on the Forex during the first week of 2021 at the price of 102.59. In October 2022, the pair reached a new summit over 32 years at 151.95. This represents a movement of 48.1% in a pair of currencies without lever effect, and as previously indicated, it is a motto that we are talking about rather than cryptocurrency or technological action with small capitalization : a movement of this nature can have repercussions, and this can lead to considerable volatility.

In the three months following this new summit, 50% of the previous trend was traced, because it was feared that the rate situation could change in the months and years to come. This did not work, because the support kept at the beginning of 2023 in this retirement of 50%, and the buyers returned to the exchange market when the federal reserve had to keep the door open to new increases in rate rate .

But it is important to highlight the red section on the graph below, as interest rates have continued to promote the United States throughout this period. What has changed are the possible expectations and developments of the rates, which illustrates that if interest rates, and in particular the divergence of interest rates, are one of the main engines of monetary trends, They are just one element, because the primordial impulse simply emanates from supply and demand.

Trading strategies for the US dollar

For Forex markets in cash, trading in USD is carried out as part of the main pairs of currencies. Thus, if the trader wishes to buy or sell the US dollar, he must take an additional step to decide against which motto he wishes to buy or sell the USD. This can generate opportunities as well as risks: if the US dollar is generally strong but the trader decides to buy the currency against, for example, the Japanese yen, it is possible that the yen is even stronger than the USD (and, in return, the euro, the pound sterling, the Canadian dollar, the Swedish crown and the Swiss franc), and this trader could still end up undergoing a loss. It is therefore not enough to simply take a stand on the US dollar, because the traders must then find the right pair of currencies for their configurations or their strategies.

To this end, given the importance of the US dollar in the world economy, it can often play a role in wider macroeconomic trends that are manifested around the world, and this trend bias can then be used in the context a broader commercial strategy. On the weekly graph below, I added the 200-day mobile average, and this can be used as a form of trend bias, as indicated in the educational article on the subject. If the US dollar follows an upward trend, as defined by its relationship with the 200 -day mobile average, traders can then seek to favor the strength of the dollar in their strategies. This might involve looking for a lower and higher resistance in EUR/USD, or may try to buy a mobile bullish crossing in a pair like USD/JPY or USD/CHF. Trendy bias itself could be used in conjunction with an entry strategy in order to try to align yourself as well as possible on market trends in the current context.

James Stanley is a New York -based strategist and writer with over 23 years of experience in the market. James began negotiating actions during the technological boom in 1999 before starting his career in industry with Merrill Lynch after obtaining a trade in Baylor University. James then worked at TD Ameritrade and Fidelity before finding FXCM and DailyFX, where he spent 13 years to help build Dailyfx Education.